What does checkpoint mean?

KPP is the reason code for registration with the Federal Tax Service. It was assigned to the organization when it was registered with the Federal Tax Service. The code is assigned to absolutely all companies. Since a bank is also an organization and a taxpayer, the checkpoint in the details is an important point.

This data is needed more for the tax service, but is also often prescribed when an organization enters into any agreements with counterparties. For standard bank transfers, bank checkpoints are rarely used. But if the submission form includes this field, then you need to fill it out.

What it is

First of all, deciphering the abbreviation KPP in accounting is very simple and represents the reason for registration carried out by the tax service. This designation consists of 9 characters indicated in the legal details. faces. As a result, this allows you to differentiate the company and obtain data about it to counterparties. Having considered how the checkpoint is deciphered, it is worth examining the three parts of which it consists:

- 1-4 characters represent information in which branch of the Federal Tax Service the company was registered. When the activities of an organization extend to several regions, they belong to the interregional department, whose first few digits in this designation are 99;

- 5-6 characters are the checkpoint, that is, the reason code for which the delivery is registered with the Federal Tax Service. The modern classification may be designated 01-50 for companies from Russia and 51-99 for foreign enterprises;

- 7-9 characters indicate the serial number used for delivery for registration. That is, they indicate the presence of the first, secondary and all subsequent deliveries for registration.

Each legal entity has statutory documents

When a company moves to another region, it needs to change the checkpoint. The numbers in the last part will depend on the number of re-registrations that occurred previously.

Why is a checkpoint necessary?

Having determined what an organization’s checkpoint is, it is important to note why it is necessary. Using this code, all interested parties are able to determine in which branch of the Federal Tax Service the company is registered. This number is considered very important for serious enterprises, because without it it is impossible to conclude large contracts or transactions, as well as participate in various tenders (especially government ones). The checkpoint must be indicated in all relevant documents. What if this is not in the details? In such a situation, the application for participation in the tender will simply not be considered, and it will also be impossible to issue certain payment orders or send a tax report.

When assigned

If an entrepreneur carefully registers his business and delves into all the details, he will learn about the checkpoint in the bank details even in the process of creating his enterprise. Its receipt occurs during the delivery process for registration on specific grounds:

- Initial registration of legal entities. a person, when at the same time he is assigned a TIN;

- There is a re-registration of the organization that has changed its location, and, accordingly, the tax authority;

- When opening a new division of the company, which is located in another region, which requires writing an application;

- Acquisition of real estate or an office in another region in the name of this legal entity.

These are just the main reasons when such an identifier is issued to an enterprise. There are also many other grounds for obtaining a checkpoint by a legal entity, which can also be used by entrepreneurs.

Sample details

Checkpoints and tenders

There are situations when the presence of such a code is mandatory and without it, serious difficulties will arise in the company’s activities, for example, it will not be possible to conclude certain types of contracts. There are certain precedents when, after submitting an application to participate in local or federal tenders, one of the conditions for participation is the indication of the checkpoint. If it is absent, such applications will not pass the filter at the first stage, and sometimes they are even automatically rejected.

Details without checkpoint

There is a division of information about the company into bank details and ordinary ones. When a company does not have a checkpoint, it indicates all the information that allows it to be identified as a legal entity: starting from the name or form of business, to the name of the parent structures, etc.

In addition, such general details are registration data provided by the activity license, as well as the corresponding certificate confirming the legality of business activities. Additionally, you can specify document numbers, legal address, OGRN, as well as the date of registration.

Checkpoint for individual entrepreneurs

Most counterparties today require individual entrepreneurs to indicate the recipient’s checkpoint in the relevant documents. Beginning entrepreneurs will not immediately learn that this is impossible, but such requests indicate a lack of legal literacy among those who request this, because the individual entrepreneur does not have such a code. They use the TIN in their payment details, which is quite enough for drawing up various documents.

Details are required to make payments

There are situations when trading partners insist and talk about the need to indicate such information. In such situations, some entrepreneurs figured out how to create similar code themselves. This method allows them to enter into the required transactions, but does not give them the legal right to use such a checkpoint in any official documents sent to government agencies. They require a dash in the corresponding line. To create a checkpoint yourself, you will need the following data:

- Number of the federal subject where the individual entrepreneur was registered.

- Code of the territorial branch of the Federal Tax Service where the entrepreneur is registered.

- Number of the first delivery for registration (001).

This information is usually enough for annoying counterparties, which allows individual entrepreneurs to conclude transactions with them, as well as conduct document exchange.

Checkpoint and Taxpayer Identification Number

In some rare cases, the checkpoint is written without a TIN. The latter is the same digital designation, which includes 10 characters. Consists of 2 blocks, where the last 5 is the individual number of a specific taxpayer. Usually these two designations are indicated together.

The difference is that a company can have several checkpoints when it has at least 1 branch, but the TIN is always the same and refers to the main office.

Not always in the legal details. persons must enter this code. Because of this, the question arises, where can I find out the payer’s checkpoint, for example, in Sberbank Online. However, this can only be done through an official written request to the Federal Tax Service. In this case, you will need to show the tax authorities your passport, as well as your TIN, after which a few days later they will provide an extract from the state register.

Based on this, the checkpoint is an important component of the details for the enterprise. Often, without such a code it is impossible to participate in tenders, enter into contracts, and also carry out document flow. Exceptions include individual entrepreneurs, who do not need to obtain a checkpoint.

Decoding checkpoint

For a person, bank account details are an incomprehensible set of numbers. It seems chaotic and meaningless. But in reality, every number has some meaning. And each number series is part of the address. Everything here is the same as in ordinary life: we have a city, a street, a house, an apartment, a bank account, a correspondence. account, BIC, INN, KPP.

Each combination in the details is a group of numbers in which certain information is encrypted. For example, let’s look at the decoding of the abbreviation KPP Sberbank 773601001:

- the first two characters are the number of the Federal Tax Service, which registered the organization. The number is assigned to a specific region. For example, in the case of Sberbank it is 77, it is registered in the capital. But for its other territorial division, for example, Siberian Bank, the checkpoint number begins with the number 54. In fact, this is the region of tax registration; This is followed by the number of the specific Federal Tax Service in the region declared in the first days, which registered the company and assigned it a code. In our case - 36;

- the next two numbers indicate the reason for registration with the tax service. In our case, this is 01 - at the location of the organization. This is the most common reason among all organizations; the next three numbers are simply the serial number of the organization in the initially specified set of values (region, specific Federal Tax Service, reason for registration).

PPC is a unique type of banking information. There are no companies in the country that have the same meaning for this code.

What do you need to know about checkpoints?

- Credit institutions often do not indicate checkpoints in their documents.

- Individual entrepreneurs do not have a checkpoint.

The Federal Tax Service and banks know about this and do not require you to fill out the checkpoint, but sometimes misunderstandings arise between counterparties. In this case, you need to refer to the registration procedure for individual entrepreneurs and the Tax Code.

- The largest taxpayers are assigned an additional tax at the place of registration as the largest taxpayer.

The first digits of this checkpoint are 99, they show that the company is registered with the interregional inspectorate for the largest taxpayers.

The checkpoint of the largest taxpayer is indicated in documents related to federal tax payments.

VAT is a federal tax, so invoices indicate the KPP of the largest taxpayer. If the checkpoint at the location of the organization is indicated on the invoice, this will not be an error and will not prevent the receipt of a deduction from the counterparty.

The checkpoint at the location of the organization is indicated in documents related to other payments to the budget and other settlements.

4 average of 4 ratings Average rating Share link

- Legislative changes

- Announcements and webinar recordings

- Accounting Tips

- Discounts and promotions

You may be interested in articles on the topic “How to start a business”

What is foreign economic activity? Definition, start of activity

Every entrepreneur has thought at least once: “I wish I could enter the world market now!” Buy mahogany from Australia and sell furniture to Sweden.” A beautiful dream, but the difficulties are frightening: customs, taxes, foreign currency, transportation and risks. In this article we will tell you what foreign economic activity is.

How to open a hostel

Budget tourism is gaining popularity in Russia. Foreign and Russian tourists are increasingly choosing hostels over expensive hotels. In the article we will tell you how to open a hostel, what documents to prepare, what area to choose, and we will also talk about financial planning and promotion.

How to open a studio

Today everyone strives to be different from others, so opening a studio can become a profitable business. The main thing is the desire and ability to create masterpieces from a scrap of fabric. How to open a sewing workshop and where to start - read our article.

Try for free for a month Try for free for 30 days Register By using the service, you agree to comply with the terms of the License Agreement Still have questions?

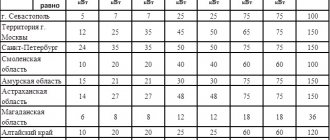

Possible reason codes for setting

The reasons for the setting may be different; a large classification has been identified. 01 - this is simply at the place of registration, but there may be other cases. The Tax Code reflects the decoding of codes, there are several dozen different cases. For example, an organization may register with a specific tax office for other reasons:

- 02 - at the location of the branch that will deal with tax issues, actually accounting;

- 03-05 - for a branch that does not deal with tax issues, for a representative office with and without such responsibilities;

- 06-08 - when registration was carried out at the location of the organization’s real estate;

- 10-29 - at the location of movable property;

- 33-34 - at the place of mining.

You will find a complete list of checkpoint codes and their exact decoding in the tax code or simply on the Internet. The maximum number of codes in the classification is 87. As you can see, there are many reasons for registration.

If the organization is relatively small, then it usually has one legal entity checkpoint. But if the company is large, has several representative offices, is represented in different regions, but each division can be assigned its own checkpoint account. For example, Sberbank is divided into 11 territorial divisions, and each has its own details.

What you can find out from the organization’s checkpoint

First of all, you can find out the tax office of the organization. To do this, just look at numbers 1-4 - this is the Federal Tax Service code . Therefore, by the number you can find out the region where the legal entity operates.

Important information is hidden by signs 5 and 6 . For example, combination 01 says that the checkpoint was assigned to a legal entity upon registration at its location. Combinations 06-08 - checkpoint assigned at the location of the property. For the largest taxpayers, the fifth and sixth digits are 5 and 0, respectively.

It is impossible to find a checkpoint organization on the tax website because it is not a unique number. To check the counterparty, use the INN or OGRN.

You can find out the checkpoint of an organization by TIN online . To do this, open the Federal Tax Service website and receive an extract from the Unified State Register of Legal Entities. It will indicate the required number.

How to find out the checkpoint?

If we consider sending a transfer using a payment order, then in its form there is always a field for entering this detail, and it is required to be filled out. If you just need to make a transfer using the details provided, you can usually do without it. It is enough to indicate the bank’s INN, BIC, current account and the full name of the account owner or the name of the organization.

When making a transfer through online banks or a third-party system, the service usually pulls up the full details from its database. That is, it is enough to enter the TIN or BIC with the account number, everything else will come out automatically.

If you still need to know where to look at the checkpoint, then it is usually reflected in the receipt if you are making a transfer to an organization. If not, and the value is needed, visit the company's website or call them on the phone.

When sending funds to an individual, it is usually done without the mandatory indication of the checkpoint number of the servicing bank. But if such a need arises, then you can contact the bank where you are sending the funds. Financial organizations always post information about their details on their websites. But be sure to choose the region you need. Information can also be obtained by calling the toll-free hotline.

How many codes can a company have?

- Any legal entity can have 2 or even more checkpoints: an enterprise can have many divisions, land plots, vehicles, subordinate to different tax departments of the Federal Tax Service. According to Article 83 of the Tax Code of the Russian Federation, each of them is registered at its location, that is, it has its own reason for registration. As many reasons for registration as there are, the organization has the same number of codes.

- In addition, in tax legislation there is the concept of the largest taxpayer. These include enterprises with a turnover of over 1 billion rubles. and a huge number of units. For example, almost all mobile operators are among the largest taxpayers.

To register such organizations, a separate network of tax inspectorates and separate registration codes have been created. For tax filings, it is generally recommended to use the CAT obtained as the largest taxpayer. But the use of checkpoints at the location of the enterprise is also allowed.

It is usually recommended to indicate the checkpoint of the largest taxpayer when paying federal taxes, for example, VAT.

Indication of the checkpoint in the UTII declaration when combining modes in 1C: Accounting 8 is shown in this video:

What details are needed for a transfer to an individual?

With such an operation, the question of what a checkpoint is usually does not arise. You are making a transfer to a person, he does not have a personal number of this type. Only the bank that services the account has it, but for such an operation the bank’s checkpoint is completely unnecessary. To send, you only need to indicate the BIC of the bank servicing the account, the individual’s account number, and his full name.

If you are making a translation specifically for a company, the list of required numbers will be larger. Instead of the full name, the name of the organization or individual entrepreneur is written, and information about the checkpoint is added. As for the servicing bank, the details are standard: the account of the company itself, cor. account, BIC.

Some people believe that KPP is a correspondent account, but this opinion is erroneous. A core account is a personal account of a bank as an organization; it can be maintained in another bank, for example, in the Central Bank of the Russian Federation.

Checkpoint certificate

A tax registration certificate is issued by the Ministry of Taxes and Duties. It contains the taxpayer number received during registration, according to which taxes are paid.

This is a document confirming registration with the tax department at the place of registration. Such a certificate is issued only to the parent company. The original of this document must be kept at the head office.

Branches and other separate divisions receive only notifications from the tax office to which they are assigned. All notifications related to divisions of the same organization indicate the same INN, but different checkpoints.

The certificate states:

- TIN of the organization,

- his checkpoint;

- date of registration with the tax office at the location of the enterprise.

The tax office has not issued paper registration certificates since January 2021. The certificate must be presented in all cases provided for by the laws of the Russian Federation. If the information contained in it changes, the certificate must be replaced. The same is required in case of its loss or damage.

Sample certificate

How to find out the bank details of an organization

Typically, companies provide their own transfer details. But they may be lost or unknown for another reason. What if you only know the company name, but you need to make a translation?

The easiest way is to visit the website of this company. If she is financially active, the information will always be freely available. If not, call, the manager can send you the necessary details by email.

You can obtain information by knowing the organization’s TIN. The TIN can be easily found on the Internet; information is freely available in special directories. If the company is large and is included in the banks’ database, then when making a payment through banking, it is enough to indicate the TIN; the remaining details, including the checkpoint, will be pulled up automatically.

We looked at what a checkpoint of an organization or bank is, how this concept is translated, and why it is needed. In general, it is important to know what a checkpoint is in the details of an individual entrepreneur or LLC; in the case of transferring to an individual, this bank details are not required.

about the author

Irina Rusanova - higher education at the International East European University in the direction of "Banking". Graduated with honors from the Russian Economic Institute named after G.V. Plekhanov with a major in Finance and Credit. Ten years of experience in leading Russian banks: Alfa-Bank, Renaissance Credit, Home Credit Bank, Delta Credit, ATB, Svyaznoy (closed). He is an analyst and expert of the Brobank service on banking and financial stability. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

How to fill out the checkpoint correctly?

Checkpoint details

According to legislative acts, when transferring money to the budget, you must correctly fill out all checkpoint fields available in the payment order.

To be more precise, the following data is indicated:

- Purpose of payment and what it is intended for

- Full information about the payer, including his checkpoint

- Full information about the recipients, also along with the checkpoint

The same is indicated in the case when funds are transferred to private companies and they do not belong to the budgetary authorities of the country.

Comments: 1

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Irina Rusanova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Alexander

01/05/2021 at 09:18 I hope everything works out

Reply ↓

What is the difference between checkpoint and tax identification number?

All business entities without exception must have both details. The TIN indicates that the legal entity is registered with the local tax office, and the checkpoint additionally explains the reason for this registration.

One enterprise can be assigned one TIN, but several checkpoints at once. This is due to the fact that some legal entities have to register with different branches of the Federal Tax Service: at the location of branches, offices or other structural units, real estate, etc.

Thus, the TIN allows you to unambiguously identify an organization, and the TIN and KPP together are its structural unit.

The TIN is assigned once and does not change during the entire existence of the legal entity. The checkpoint is a changeable detail: for example, it will be reassigned if the organization has changed its place of registration and moved to another branch of the Federal Tax Service.

Explanation of the abbreviation CAT

The props are a set of digital symbols. They are written in a row without spaces, but in reality they are divided into several groups in which the following information is encrypted:

- The first two characters characterize the code of the subject of Russia where the tax authority that assigned the checkpoint is located. For the Moscow region it is 50, for the capital – 77, and for interregional inspectorates that work with the largest taxpayers – 99.

- The third and fourth digits encrypt the number of the tax service unit that assigned the checkpoint and processed all the information required to register a business entity. For example, for Moscow tax inspectorate No. 23, this part of the code will correspond to 23.

- The fifth and sixth characters encrypt the reason why the organization is registered. There is an officially approved guide that lists all the options. If the largest taxpayer is registered, then code 50 is set. Their own combinations of numbers are provided for the reasons “location of real estate”, “location of separate structural divisions”, etc.

- The last three characters are the number (in order of priority) of registering a business entity for its own reason with the local tax authority.

Where and how to find out your or someone else's checkpoint

Current information on current taxpayers of the Russian Federation is available on the official website of the Federal Tax Service. But if you need information just for reference, then enter the name of the company you are interested in in any search engine . All the results found will be displayed on the screen - you just need to go to the official website of the company.

As a rule, all legal details are on their websites. Also, such information is provided by a variety of reference resources posted on the Internet.

How to determine the checkpoint by TIN or company name on the Federal Tax Service website :

- go to the main page of the Internet resource: https://www.nalog.ru;

- click on the subsection “Business risks: check yourself and your counterparty”;

- enter the TIN and click “Find”:

*click on the picture to open it full size in a new window - Information about the desired legal entity will appear on the screen, including the checkpoint.

Upon closer examination, everything complex becomes simple. Read our blog and you will see for yourself!

Tax authorities constantly require us to be careful when choosing suppliers, and it is accountants who are forced to carefully check all documents and pay attention to all kinds of details. We have long been accustomed to these abbreviations - INN and KPP. And it seems that no questions can arise here. Meanwhile, if many people have an idea about the TIN and know where to check it, then, apart from how the checkpoint is deciphered, as a rule, no one else knows anything about it. These are the questions we are asked.

The checkpoint will help you determine who you are dealing with: an organization or its branch

For all our counterparties, the checkpoint ends with 01001. But recently, while filling out a payment form, I discovered some strange checkpoint from a new supplier - the last numbers are 43001. How do you understand what this means?

: Such a checkpoint means that you are transferring money to a branch of your counterparty and Letter of the Federal Tax Service of Russia dated 06/02/2008 No. CHD-6-6/ [email protected] .

For example, KPP 770601001 means that the organization is located in Moscow and the Federal Tax Service of Russia No. 6 for Moscow registered it as a taxpayer at its location (code 01).

If the checkpoint numbers (ZZ) are not 01 (for example, like your counterparty’s - 43), then this means that the organization was registered on other grounds.

A complete list of reason codes for registration is given in the departmental directory (SPPUNO) approved. 10/11/99. But this guide is an internal document. And if previously it was posted for public viewing on the official website of the Federal Tax Service, now it is problematic to find it in the public domain. But we will tell you what some codes mean.

Here and here you can try to get a transcript of the checkpoint - find out the region and inspection that registered your counterparty, the reason for registration. But this information is unofficial.

| Code | Reason for registration |

| 02*, 03*, 43 | Registration of a branch of a Russian organization |

| 04*, 05*, 44 | Registration of a representative office of a Russian organization |

| 31*, 32*, 45 | Announcement about the opening of a separate division of a Russian organization |

* These codes are not currently assigned Letter of the Federal Tax Service of Russia dated 06/02/2008 No. CHD-6-6/ [email protected] . But checkpoints with these codes assigned earlier remain valid.

Gearbox may change

Our counterparty's checkpoint has changed. OGRN and TIN remain the same. What does this mean? Moving? Or could there be other options?

: The organization may have a new checkpoint, in particular clause 2.1.4 of the Procedure:

when changing the location of the organization (moving), when you have to register with another tax office;

Moving a company to a new location is the most common reason for changing checkpoints

Most often, the checkpoint changes if an organization moves and has to register with another tax office and clause 2.1.4 of the Procedure; subp. “c” clause 1, clause 5 art. 5 of the Federal Law of 08.08.2001 “On state registration of legal entities and individual entrepreneurs”. For example, if the checkpoint used to be 77 07 01001, and then became 77 19 01001, this means that your counterparty was registered with the Federal Tax Service Inspectorate No. 7 for Moscow, and now with the Federal Tax Service Inspectorate No. 19 for Moscow.

If other numbers have changed in the checkpoint, for example, the reason code for the statement, then it is better to check with your counterparty to see if it is correct.

Different organizations may have the same checkpoint

Three of our counterparties have the same checkpoint. Is there something wrong with them? Or is this possible?

: Yes, it's possible. Unlike the TIN (a unique number that is assigned to an organization once at the time of registration and is not changed by clause 7 of article 84 of the Tax Code of the Russian Federation; clause 3.1 of the Procedure), the checkpoint determines whether the organization belongs to a particular tax authority, as well as the reason for registration accounting Therefore, it may be the same for organizations registered with the same tax office on the same grounds, clause 1 of the Procedure.

The branch, when issuing an invoice, indicates its checkpoint in it

We purchased goods from a branch of our counterparty. He issued us an invoice on behalf of the parent organization, and indicated his own (branch) checkpoint. Is it correct? Can we be denied a deduction if the wrong checkpoint is indicated?

: Your counterparty did everything correctly. The regulatory authorities believe that when selling goods through separate divisions, the invoice must be issued on behalf of the parent organization, that is, in lines 2, 2a, 2b the name, tax identification number, location of the organization itself must be indicated, and in lines 2b and 3 - KPP and address of a separate division (branch) Letters of the Ministry of Finance of Russia dated May 23, 2011 No. 03-07-09/12, dated April 1, 2009 No. 03-07-09/15, dated October 22, 2008 No. 03-07-09/33; Letter of the Federal Tax Service of Russia for Moscow dated 07/07/2010 No. 16-15/071188.

As for the deduction of VAT, previously tax authorities quite often refused it in the absence of a checkpoint or its incorrect indication, but the courts never supported them and Resolution of the Federal Antimonopoly Service of the Moscow Region dated December 17, 2008 No. KA-A40/11795-08; FAS NWO dated October 23, 2008 No. A56-39361/2007; FAS North Caucasus Region dated 06/04/2008 No. Ф08-3055/2008, dated 10/28/2008 No. Ф08-6493/2008. And after amendments were made to the Tax Code of the Russian Federation and clause 2 of Art. 169 of the Tax Code of the Russian Federation, according to which errors in invoices that do not prevent the identification of the seller are not grounds for refusal to deduct; there should be no problems at all. After all, the checkpoint does not interfere with such identification.

KPP is not assigned to entrepreneurs

Our buyer, an entrepreneur, sent us the details where the checkpoint is indicated and stated that he really has the code, but he cannot find a document confirming this. Do individual entrepreneurs have checkpoints?

: No, KPP is not assigned to entrepreneurs. It is assigned only to legal entities under clause 1 of the Procedure; forms No. 1-1-Accounting, No. 2-3-Accounting, approved. By order of the Federal Tax Service of Russia dated December 1, 2006 No. SAE-3-09/ [email protected] .

When issuing a payment order in which the payee is an entrepreneur, the “Checkpoint (103)” field is not filled in clause 2.10 of the Regulations on non-cash payments in the Russian Federation, approved. Bank of Russia 03.10.2002 No. 2-P. However, if your bank asks you to fill in this detail, you can enter 0.

The largest taxpayers are assigned an additional checkpoint

We noticed that in the invoices issued by our counterparty, the checkpoint has changed - it used to start at 7701, and now at 9971. But it indicates the same address as before. What could this mean? Will this cause us to have problems with deducting input VAT on such invoices?

: The new checkpoint means that your counterparty has acquired the status of the largest taxpayer. And such taxpayers are registered with one of the Interregional Inspectorates for the largest taxpayers and are assigned an additional KP P clause 1 of Art. 83 Tax Code of the Russian Federation; Order of the Ministry of Finance of Russia dated July 11, 2005 No. 85n; clause 5 of the Criteria. approved By order of the Federal Tax Service of Russia dated May 16, 2007 No. MM-3-06/ [email protected] . Thus, they have two checkpoints: at the place of registration as the largest taxpayer and at the location.

Interregional inspectorates for the largest taxpayers have a code in which the first two digits are 99, and the next two digits indicate the inspection number (for example, 9971, as in your case, is the Interregional Inspectorate of the Federal Tax Service for the largest taxpayers No. 1, 9972 is the Interregional Inspectorate of the Federal Tax Service for the largest taxpayers). taxpayers No. 2, etc.) Classifier “Tax Authorities Designation System” (SONO).

The Ministry of Finance recommends that invoices indicate the checkpoint assigned to the taxpayer as the largest. True, if your supplier indicates in the documents the checkpoint assigned to him at his location, then this will not be considered a violation of Letter of the Ministry of Finance of Russia dated May 14, 2007 No. 03-01-10/4-96. And you still shouldn’t have any problems with deducting VAT regarding clause 2 of Art. 169 Tax Code of the Russian Federation.

Registration reason code (KPP)

is a nine-digit code that the tax office assigns to an organization when registering for tax purposes.

The checkpoint is necessary because some companies are registered with several tax inspectorates: not only at their legal address, but also at the location of separate divisions, real estate and taxable vehicles.

Since everyone must have the same TIN, the tax authorities introduced an additional code - KPP.

This code shows why the company is registered with this inspection.

One company may have several checkpoints.

A reason code for registration is assigned for each basis for registration, including the location of the organization itself, its separate subdivisions (SU), land plots and other real estate, and transport.

Unlike the TIN, the reason code for registering an organization may change.

So, if an organization changes its address to another address that belongs to a different tax office, the company will be assigned a new checkpoint.

The value of the checkpoint can be found out from the certificate or notification of registration.

The checkpoint of the organization at its location is also indicated in the Unified State Register of Legal Entities (USRLE).

The first four digits of the checkpoint represent the code of the tax authority with which the organization is registered.

Of these, the first two digits are the region code, and the third and fourth digits are the tax office code (number).

For example, a checkpoint starting with 7713 means that the organization is registered with the Federal Tax Service No. 13 for Moscow.

The fifth and sixth digits of the checkpoint indicate the reason for registration.

numbers 01 mean that the checkpoint was assigned to the organization in connection with registration at its location;

numbers 02, 03, 04, 05, 31 or 32 mean that the checkpoint is assigned to the organization at the location of the separate division of the organization;

numbers 06-08 mean that the checkpoint is assigned to the organization at the location of the real estate it owns (thus, vehicles are not affected), depending on the type of property;

numbers 10-29 - mean that the checkpoint is assigned to the organization at the location of its vehicles, depending on the type of vehicle;

the numbers 50 mean that the checkpoint was assigned in connection with registration as the largest taxpayer.

The last three digits of the checkpoint represent the serial number of the organization's registration with the Federal Tax Service on the basis for which this checkpoint was assigned to it.

Organizations must indicate TIN and KPP in all documents intended for tax inspections.

Thus, the organization’s checkpoint should indicate:

in all tax returns and calculations;

in payment orders, including payment orders for the payment of taxes and insurance premiums;

in invoices and other documents where the checkpoint must be indicated.

Since an organization may have several checkpoints, the document indicates the code assigned by the tax office, which is intended for this document.

Still have questions about accounting and taxes? Ask them on the accounting forum.

Why do checkpoints of one organization/bank differ in different regions?

The answer is that the checkpoint is formed for the branch/division based on location and affiliation with the Federal Tax Service. If we take Moscow, then there are several Federal Tax Service, so different branches of the same bank may have different checkpoints. Most often, banks use the process of opening and maintaining accounts on different balances. If you open an account in a bank office and open another account in the online account, then their details will be different, since the first account is opened on the balance sheet of the branch, and the online account is opened on the balance sheet of the main branch, most often on the central one.

If a bank opens branches in different regions, then in each it is obliged to apply for registration with the Federal Tax Service no later than the first month from the date of opening. In this case, you do not need to carry the entire package of documentation. It is enough to fill out form No. C-09\3\1 and submit it to the Federal Tax Service. Within five days, the Federal Tax Service notifies the central office of the bank about the registration of a new division and the formation of a checkpoint.

Again, in order not to get confused with the details, you can always check the current ones in your personal account by going to the “account details” section. During the merger process, banks change their details, including checkpoints. Therefore, it is not worth looking at the details in the old contract. They may have already been changed. The bank notifies about the change by publishing information on the bank’s website or information stands.

Thus, the checkpoint allows you to determine whether the bank is a taxpayer, in which region taxes are paid, to what extent taxes are paid, and whether the bank has branches. The checkpoint is a kind of addition to the TIN.

A legal entity without a checkpoint cannot participate in serious government procurement or tenders. If you do not indicate the checkpoint in the application or put 0, then the application for participation will definitely be rejected. In this way, IPs who try to participate are cut off.

The checkpoint does not replace the TIN, but is only its addition. It allows you to quickly identify a bank/branch. To avoid problems and questions, checkpoints are indicated in payment orders, service agreements, declarations, and primary documentation.